The Loan Application Process

Frequently Asked Questions

ROLF is funded from several sources, including the US Department of Commerce/Economic Development Administration (EDA, United States Department of Agriculture (USDA)/Rural Development, and the Washington State Department of Commerce.

Loans of $500 to $250,000 are available depending on the location of the business/the intended use of funds/loan funds used. We can finance a maximum of 75% of the total business project. The loan amount is subject to the business’s ability to meet applicable job creation guidelines.

Our loans can finance the purchase of land/real estate, working capital, and equipment. Loans cannot be used for: refinancing (unless the refinancing is necessary for the business to remain or become viable); payment of tax obligation; or making payments on existing debt, which includes payments on other loans.

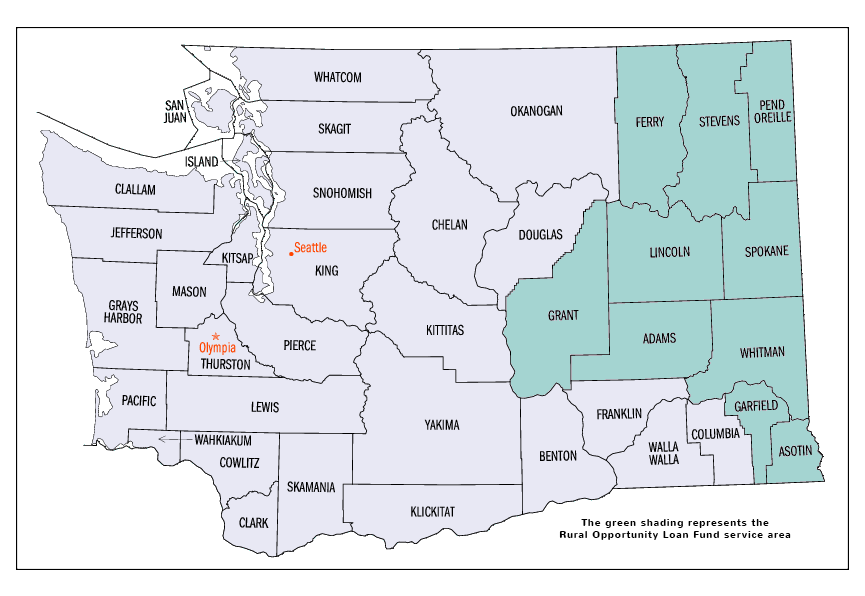

Thirteen Eastern Washington counties, including Adams, Asotin, Chelan, Douglas, Ferry, Garfield, Grant, Lincoln, Okanogan, Pend Oreille, Stevens, Whitman, and (rural) Spokane counties.

To qualify for the Rural Opportunities Loan Fund, you must present a rejection letter from a bank or other lending institution. We also require that applicants submit a completed Loan Fund Application and supporting documentation, including a business plan, personal and business financial information, pro forma financial projects, and the current valuation of your collateral. There is a non-refundable, $50 loan application fee.

Applications are reviewed by a Loan Committee which has final loan approval authority. Applications are reviewed based on each potential borrower’s credit listing, character, collateral, business plan, ability to repay the loan, and the economic impact on the community.

Not necessarily. ROLF provides funding to businesses that are unable to secure adequate financing from conventional sources; we are not a subsidized, low-interest program.

This institution is an equal opportunity provider and employer. This is an Equal Opportunity Program. Discrimination is prohibited by Federal Law. Complaints of discrimination may be filed with the USDA, Director, Office of Civil Rights, Washington, DC 20250